Report|China’s Semiconductor Conundrum: Understanding U.S. Export Controls and Their Efficacy

2025-09-08

Topic|China’s Semiconductor Conundrum: Understanding U.S. Export Controls and Their Efficacy

Time|September 8, 2025, 14:00–16:00 Taipei Time (GMT+8)

Venue|Online

Speaker|Megha Shrivastava (MoFA Taiwan Fellow and Visiting Scholar, Institute of National Defense and Security Research, Taipei, Taiwan)

Moderator|Joyce C.H. Liu (Director/Professor, International Center for Cultural Studies, National Yang Ming Chiao Tung University)

Event Info|LINK

Event Photo|LINK

Event Record|LINK

Reported by|Dolma Tsering

Sub-project|Subproject II: The Chip Era and Digital Governance

Convener|Joyce C.H. Liu

As the foundation of our modern, digitally driven civilization, powering everything from smartphones to artificial intelligence, the semiconductor industry has become one of the most critical battlegrounds in contemporary great power competition. Control over semiconductor production and distribution has emerged as a defining strategic concern. On September 8, the International Center for Cultural Studies (ICCS) of National Yang-Ming Chiao Tung University hosted Megha Shrivastava, a fellow under the Ministry of Foreign Affairs Fellowship and Visiting Scholar at the Institute of National Defense and Security Research, Taipei. She presented her research on the efficacy of the United States’ export control strategy targeting China's semiconductor industry.

The discussion examined three central questions:

Through these three questions, the discussion explored the intricate dynamics of chips, geopolitics, and the emerging world order.

I. Landscape of the Global Semiconductor Supply Chain Production

Megha emphasized the importance of understanding the global semiconductor supply chain landscape to develop a nuanced understanding of the contemporary rivalry between the U.S. and China in the semiconductor industry. There are three critical stages in chip production, each requiring specialized technologies, minerals, and expertise.

The first stage is design, which relies on intellectual property and sophisticated Electronic Design Automation (EDA) software. Here, the U.S. leads with processor architectures, design libraries, and advanced software tools, giving Washington significant leverage in upstream technologies. The second stage is fabrication, which depends on advanced equipment such as deep ultraviolet (DUV) and extreme ultraviolet (EUV) lithography machines, etching systems, and ion implanters, along with raw materials like silicon wafers, photoresists, and specialty gases. Taiwan, through TSMC, and the Netherlands-based company ASML dominate global production of advanced chips. The final stage involves assembly, testing, and packaging (ATP). While less technologically complex, this stage is essential for bringing chips to market. China has built substantial capabilities here, accounting for roughly 20% of global ATP capacity. Notably, no single country dominates all stages, making chip production what Megha describes as “highly complicated yet fragmented.” Consequently, any export control measures against countries involved in chip production require unprecedented levels of international coordination, while also providing multiple avenues for circumvention by targeted nations.

Historically, leveraging its dominance over upstream technologies, the United States in the 1980s securitized the semiconductor industry and imposed export controls on Japan. Today, with growing concerns over China’s unprecedented influence and power in the semiconductor industry, the United States is employing a similar strategy of a chip embargo against China. This underscores that semiconductors are not merely an economic necessity but a strategic asset, central to the global power rivalry between the U.S. and China.

II. United States Export Control Policies Toward China: Trump 1.0 and Biden

Megha emphasized that President Trump’s approach toward China witnessed a major shift in American policy, from engagement (under Obama) to strategic competition. Beginning in 2017, key documents, including the U.S. Trade Representative report and, in 2020, “Trump on China: Putting America First,” portrayed China as a revisionist power challenging American hegemony across economic, technological, and military domains. This ideological framework set the stage for increasingly aggressive policies.

Trump’s strategy unfolded across four dimensions. First, narrative-building framed China as an existential threat, legitimizing harsher measures and rallying domestic support. Second, the administration implemented a trade war, imposing tariffs beginning at 25% on $50 billion of Chinese goods and expanding coverage over time. Third, the Entity List was employed to restrict Chinese firms, including ZTE and Huawei, from accessing U.S. technologies without government approval. Finally, Trump sought allied coordination through the Indo-Pacific Strategy and Quad partnership, recognizing that technological containment required multilateral cooperation.

The Biden administration intensified Trump’s strategy but narrowed its focus to semiconductors, identifying them as China’s “weak spot” critical to AI and military modernization. Biden’s approach rested on three pillars: preventing China from accessing advanced chips while boosting domestic capabilities through the CHIPS and Science Act (2021); coordinating with allies, exemplified by 2023 agreements with Japan and the Netherlands to restrict lithography exports and chemical supplies to China; and constraining China’s high-end semiconductor growth by targeting technologies at 7 nanometers and below, including draft rules limiting access to U.S. cloud services for AI.

Biden’s concentrated focus on China’s semiconductor industry is reflected in the more than doubled number of Chinese firms on the Entity List, from 183 under Trump to 425 by 2022, with Huawei and ZTE also facing Foreign Direct Product Rule (FDPR) bans. Central to Biden’s administration strategy was the “chokepoint strategy,” blocking China’s access to critical nodes in design (EDA software, IP), fabrication (EUV machines), and AI infrastructure (cloud platforms, GPUs). Taiwan remains pivotal due to its advanced fabrication capabilities. The U.S. deepened ties with Taipei, encouraged the reshoring of TSMC facilities (e.g., Arizona fab), and integrated Taiwan into broader semiconductor diplomacy. This reflects concerns that a Chinese takeover of Taiwan would threaten global supply chains and U.S. national security.

In summary, U.S. policy evolved from Trump’s broad economic and technological confrontation to Biden’s focused containment of China’s semiconductor industry, aiming to delay its growth while strengthening domestic and allied capabilities.

III. China in the Global Semiconductor Supply Chain and Response to U.S. Export Controls

Megha argued that China’s response to the U.S. chip sanctions reveals both the resilience and adaptability capabilities of its technological ecosystem. China implemented a comprehensive strategy combining defensive measures with accelerated indigenous development efforts and retaliatory measures against the U.S. companies. One of the key aspects of defensive measures was that in 2022, the Chinese government announced major state-led funding for reshoring domestic manufacturing and materials capabilities, coordinated between state-owned and private enterprises. The “Big Fund” initiative, first launched in 2014, evolved significantly in response to American pressure. Big Fund 2.0, introduced in 2019, expanded funding while sharpening focus on memory semiconductors and advanced manufacturing equipment. The most recent iteration, Big Fund 3.0, launched in 2024 with approximately $48 billion in funding, nearly matching the scale of the American CHIPS and Science Act. This state-led approach of increased funding represents a fundamental shift in Chinese industrial policy, moving from broad economic development to targeted technological competition. The funds coordinate contributions from state-owned banks, state-owned enterprises, and private companies, creating a comprehensive financing ecosystem for semiconductor development that targets chokepoint technologies, including design and equipment.

Subsequently, China made several key innovations due to these policy choices. The first was Huawei's Tashan project in 2020. Second, also in 2020, the development of domestically produced 28-nanometer lithography machines marked a major milestone, showing China's ability to create vital manufacturing equipment locally. These technological advances represent significant progress toward technological independence in critical manufacturing processes, even though these machines are still behind the most advanced equipment from ASML. Megha stressed that these achievements after the restrictions show strong evidence of the country’s ability to adapt.As part of the retaliatory approach, in 2023, China blocked U.S. chipmaker Micron Technology, a major American memory chip manufacturer, from doing business in China. More strategically significant have been China’s restrictions on the export of gallium and germanium, critical materials for semiconductor production, where China maintains dominant global market positions. These restrictions, implemented in 2023, highlighted the vulnerability of global supply chains to Chinese retaliation while demonstrating that technological competition involves multiple potential pressure points.

IV. Failure of U.S. Export Control Policy for China’s Technology Containment

Megha argued that U.S. export control policies have effectively failed to contain the growth of China's semiconductor industry. This argument is based on two main reasons. First, as explained in the previous section, she argued that U.S. export control policy has boosted domestic investment in the semiconductor industry, which subsequently helped produce indigenous 28-nanometer chips and the Tashan project. Major developments like DeepSeek AI provide another example. Second, based on data from various Western companies’ revenue and market engagement in the post-ban phase, American export controls have had little impact. For instance, focusing on two leading companies, ASML, a Dutch equipment supplier, and TSMC from Taiwan, trends from 2022 to 2024 reveal that despite sanctions, their share of the Chinese market remained relatively stable. While overall revenue growth slowed compared to prior years, marginal growth persisted, indicating that restrictions did not completely curtail business with China. TSMC experienced an immediate decline in revenues in 2020, coinciding with the first wave of U.S. export controls. However, by 2023, TSMC’s revenue from China had largely recovered, reflecting rising demand driven by generative AI technologies and higher-end GPUs, which TSMC supplies extensively. Although its market share in China declined slightly post-2023, the overall rebound suggests that sanctions had limited long-term effects on its business.

There are three key reasons for this failure, which can be understood as the limitations of attempting to control a complex, interconnected global semiconductor industry. The first was the emergence of shell companies, which played a significant role. Anticipating potential restrictions, China prepared by establishing alternate entities before and during the post-Huawei ban phase in 2022. When U.S. export controls were implemented, these shell companies enabled continued trade with American firms, circumventing restrictions and supplying domestic chipmakers with critical technologies. Second, limiting technology transfers incentivized China to develop alternative solutions. Chinese firms replaced restricted technologies with domestic or clandestinely sourced alternatives capable of performing similar functions, including equipment and chips at comparable nanometer scales. Third, loopholes in existing policies allowed certain American chipmakers to indirectly supply Chinese companies. For instance, NVIDIA’s H100 chips ultimately reached Chinese firms through alternative channels despite restrictions. Similarly, revenues of ASML and TSMC post-sanctions demonstrated that both these companies managed to reach the Chinese market despite the sanctions. However, even when China's AI development efforts seem to have been accelerated as a result of US sanctions, it is also useful to recognise that, in the absence of American export controls, the trajectory of China's AI growth would have been different and could potentially be in the worst interest of Washington.

Conclusion

The United States’ export control measures to contain the growing capacity of China’s semiconductor industry have failed in both the short and long terms, as Megha concluded. In the short term, especially recently, the industry has shown signs of recovery despite temporary setbacks in growth and revenues of certain Chinese firms in the early phase of the ban. In the long term, as discussed in section three, China has demonstrated its determination to catch up through massive investment and incentives for domestic chip production. To conclude, Megha argued that instead of containing China’s capabilities, the U.S. chip embargo has spurred greater self-reliance, resource mobilization, and resilience in China’s semiconductor industry.

Discussion Forum

Professor Joyce led the discussion with questions about what China’s priorities are in domestic chip development, such as military applications, AI, or surveillance. In other words, where is the push for indigenous chips strongest? To this, Megha answered that China’s strategy emphasizes two vulnerable choke points. First is the high-end chip production (7nm and below). The release of Huawei’s Mate 60 Pro (2023), featuring a 7nm chip, demonstrated China’s ability to advance despite U.S. sanctions. This was symbolically important for domestic legitimacy. The second is the equipment manufacturing areas, like extreme ultraviolet (EUV) lithography, which have long been dominated by foreign suppliers. Dolma asked a question about the implications of the ban on global companies like NVIDIA, which is heavily dependent on the Chinese market. To this, Megha answered that many firms exploited loopholes and lobbied Washington to relax measures. Tech CEOs such as NVIDIA’s Jensen Huang play a mediating role, emphasizing that sanctions hurt U.S. commercial interests without decisively halting China’s progress.

近期新聞 Recent News

Report|Conceptualizing Digital Governance in the Age of Semiconductors: A Critical Review of Keywords and Concepts

2025-12-03

more

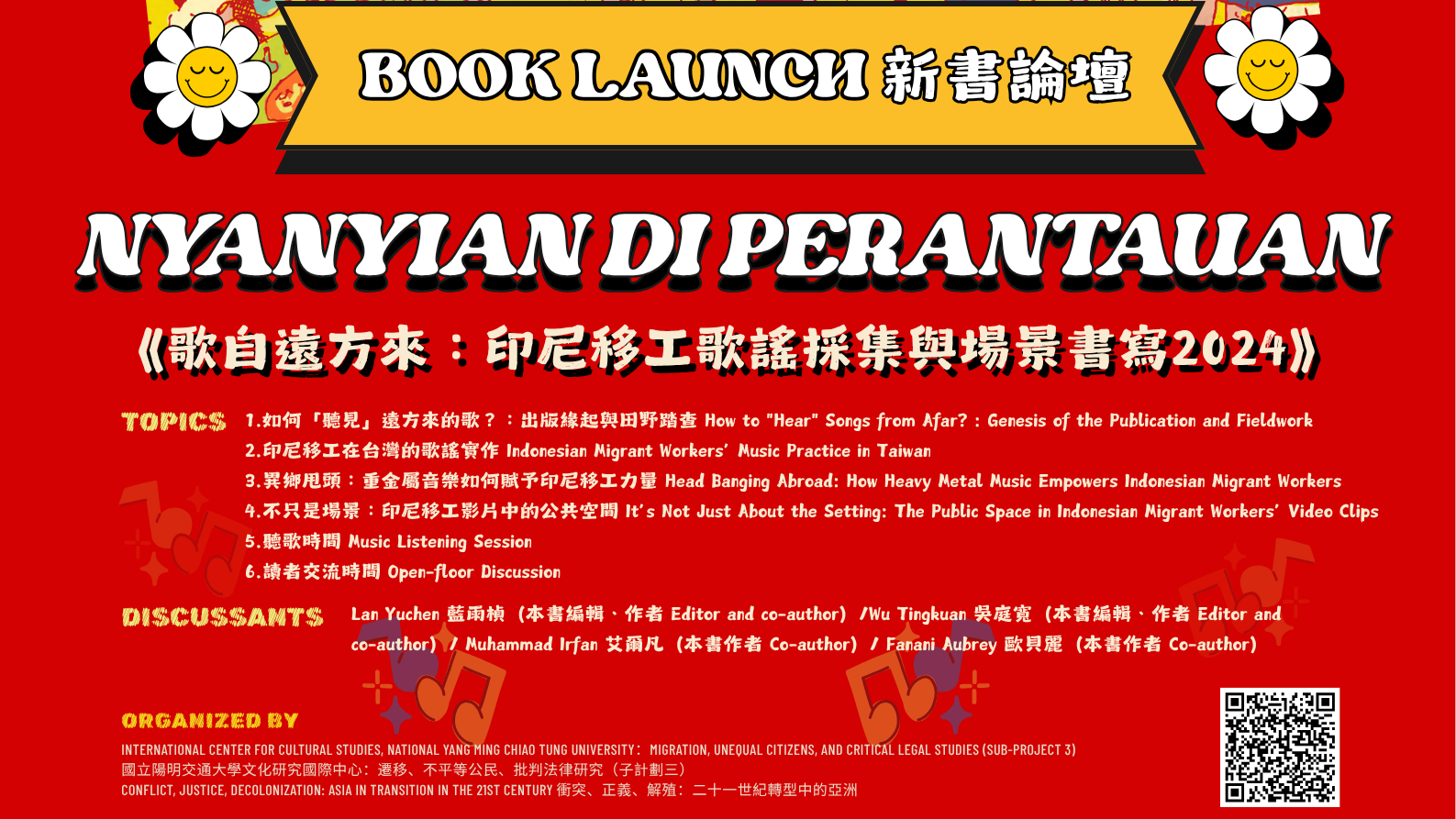

Report| Book Launch: Nyanyian di Perantauan: Kumpulan Lirik Lagu Pekerja MigranIndonesia & Laporan Skena Musik di Taiwan 2024

2025-11-22

more